31 Dec 2007, 11:59PM PT

13 Dec 2007, 12:00AM PT

Closed: 31 Dec 2007, 11:59PM PT

Earn up to $2,000 for Insights on this case.

A major IT vendor is trying to figure out how it can take advantage of the growth in the online game sector. It needs to determine what the global demand is for online games that require highly scalable infrastructure (Massive Multiplayer Online Games such as World of Warcraft and online leisure games, but not console games).

This vendor is trying to learn who the major online game operators are, where they are located (region or major country) and what the market capitalization of these companies is. They also want to determine how much these companies spend on systems, hosting and storage. (Please provide the source for any data you use in your response).

Who should be the largest or fastest-growing customers that this vendor should target? Who are the key hosting companies for online games? What equipment are these companies buying? Are there any specific strategies that you would recommend for a company looking to play a major role in this market?

Clarification: The sponsor for this Case is interested in IT infrastructure such as servers, processors, OSes, hard drive storage -- hosting equipment that can be bundled and packaged with management software, etc.

9 Insights

Where To Sell Hardware For The Online Gaming Market? by Devin Moore

Where To Sell Hardware For The Online Gaming Market? by Devin Moore

Monday, December 17th, 2007 @ 7:20AM

A selection of the top game companies:

Activision, Inc. ATVI 26.37 -0.35 (-1.31%) 7.68B KONAMI CORPORATION (ADR) KNM 32.47 -0.25 (-0.76%) 4.46B Microsoft Corporation MSFT 34.97 -0.34 (-0.96%) 327.16B THQ Inc. THQI 26.64 +0.03 (0.11%) 1.76B Take-Two Interactive Software, Inc. TTWO 18.45 -0.03 (-0.16%) 1.37B Midway Games Inc. MWY 3.01 +0.09 (3.08%) 277.35M Atari, Inc. ATAR 1.55 -0.05 (-3.12%) 20.89M Time Warner Inc. TWX 16.73 -0.16 (-0.95%) 60.47B InfoSpace, Inc. INSP 17.80 -0.20 (-1.11%) 592.10MElectronic Arts Inc. ERTS 57.77 -0.31 (-0.53%) 18.20BThe biggest one isn't listed on the NYSE:

Vivendi Universal SA http://new.quote.com/global/stocks/quote.action?s=VIV_EUR-SWX&fromSearch=tru e

Vivendi owns Blizzard which makes World of Warcraft.

My advice to companies looking to play a major role in this market: sell large quantities of bare-bones systems, with full hardware support on-site. Game companies don't want some packaged software stuff, they just want the highest volume, highest CPU per dollar of their money. If you will service the hardware, they'll do the software. Most of them have proprietary software anyhow, so if you can deliver the cheapest, most reliable hardware, you'll win.

Where To Sell Hardware For The Online Gaming Market? by Richard Miller

Where To Sell Hardware For The Online Gaming Market? by Richard Miller

Monday, December 17th, 2007 @ 10:09AM

Utility game hosting is a promising growth area, given the cost issues, scalability challenges and operational overhead of operating a major multiplayer game or virtual world. This opportunity is likely to expand as the growth of the online gaming sector offers opportunities to smaller game publishers and developers.

I believe these platforms offer the largest area of opportunity for IT vendors, presenting the potential for a single provider relationship to offer pass-through sales and service opportunities to a larger ecosystem of game publishers and developers that deploy their content on these new platforms.

The global demand for gaming infrastructure is significant. The industry is maturing and attracting significant investment from venture capital firms. In social gaming, an eMarketer report released in September (http://www.news.com/8301-10784_3-9783551-7.html) estimated that 8.2 million children of the US have accounts in virtual worlds, or roughly a quarter of the population of 3-year-old to 17-year-olds online. That number is up from 5.3 million kids in 2006, and is projected to grow to 12 million next year and 20 million by 2011. The NPD Group reports similar trends: http://www.npd.com/press/releases/press_071016a.html.

Other useful sources in tracking the growth of online gaming include Virtual Worlds News (http://www.virtualworldsnews.com/) for tracking venture capital investment in game companies (a good leading indicator of later infrastructure investment) and GameStudy (http://gamestudy.org/eblog/) for insight on the Korean gaming sector. MMOG Chart (http://www.mmogchart.com/) provides an overview of the growth of largest massively multiplayer online games (MMOGs) through 2006.

Those numbers and trends explain why data center infrastructure companies are targeting the gaming market, with some seeking to offer a plug-n-play utility hosting infrastructure for gamers. These offer an attractive entry point for IT vendors seeking a larger presence in online gaming.

Here are three providers that illustrate this trend:

- Global NetOptex (GNi) offers a turnkey "pay as you grow" game hosting solution for MMOs. It currently hosts traditional MMOs like Hellgate: London, but also social gaming providers such as GoPets that feature virtual economies. GNi partnered with Online Game Services Inc. (OGSI) in developing a utility game hosting offering, and then bought OGSI in Feb. 2007 for $3 million. Their vision was to create a platform that would level the economic playing field and allow smaller gaming companies to develop MMOs. Company executives say established MMOs have found the platform's scalability attractive. GNi uses high-density blade server installations (see more at http://www.datacenterknowledge.com/archives/2006/Nov/08/mmo_game_host_deploys_10 00_blade_servers.html) and says OGSI deployed more than $20 million in infrastructure in the 5 years before it was acquired. GNi hosts its infrastructure primarily in data centers operated by 365 Main and CRG West (Carlyle Group). GNI has 56 employees and had 2006 revenue of $8.1 million, according to its entry in the Inc. 500 (number 349 overall): http://www.inc.com/inc5000/2007/company-profile.html?id=200703490 . Theirweb site is at http://www.gni.com

- On Nov. 2 infrastructure service provider Terremark Worldwide (NASDAQ:TMRK) launched the Terremark Interactive Entertainment Group to provides managed infrastructure for virtual worlds and social networking sites. "We are seeing significant demand for our services from companies dedicated to bringing online gaming applications, virtual worlds, and social networking sites to market," said Marvin Wheeler, President of Terremark’s U.S. Commercial Business Unit. "Our portfolio of managed services is ideally suited for large-scale performance-intensive applications such as massively multiplayer online games." Terremark has a market capitalization of $342 million, and is investing $250 million to expand its data center infrastructure beyond its home base of Miami, adding data center complexes in Culpeper, Virginia and Santa Clara, Calif. Company web site: http://www.terremark.com. Their presence in three Internet connectivity hubs positions them well for bandwidth-intensive gaming apps.

- On Dec. 4 another publicly held data center provider, Switch and Data (NASDAQ:SDXC) also launched a new practice focused on providing specialized infrastructure and services to online gaming companies. To lead the division, Switch and Data hired David Reitman, an industry veteran who previously led AT&T's Digital Media & Online Game Services - which is significant since AT&T has been perhaps the largest provider of MMORPG infrastructure, hosting Blizzard's World of Warcraft as well as games for Sony Online Entertainment. "The infrastructure needs of the leaders in the content and entertainment industries - from power and cooling to network connectivity and bandwidth - are huge," said Reitman. Switch and Data is one of the market leaders in network peering with its PAIX unit, providing opportunities for gaming companies to save money on bandwidth through direct connections with other networks. See http://www.switchanddata.com/press.asp?rls_id=110 for more. Switch and Data has a market capitalization of $563 million, with more than 800 customers in 34 data center around the US. Switch and Data has facilities in the major Internet connectivity markets, but also has data centers in smaller markets where larger peering providers like Equinix and Telehouse have no presence, a footprint that may also offer growth opportunities as the gaming market expands.

These are three examples of what will be a broader trend. I haven't identified similar players in Asia, but will be similar opportunities in these markets for providers with established data center infrastructure in place.

|

Richard Miller Mon Dec 31 9:02am |

I wanted to add several additional comments on growth strategies for MMO/virtual worlds infrastructure: EXISTING PROVIDERS AND OPERATORS - Energy Efficiency: Most large existing MMORPGS and virtual worlds have relationships with hardware and software vendors. Energy costs will be a growing issue for these companies, as they run a lot of servers and many use high-density installations (which, in addition to their power usage, create design challenges for the data center infrastructure). As these companies upgrade and refresh their hardware, energy efficiency will be a more important selection criteria than in the past, and could affect choices for servers and storage in particular. In pitching providers with large existing infrastructures, energy efficiency will be an effective strategy for getting customers to consider new vendors and products. - Interoperability: This is a longer-term issue, but there is growing interest in frameworks that will allow users from one virtual world to interact with others in an open "metaverse" environment. This interoperability may require specific software and hardware requirements, and developing products and expertise in this niche could position an IT vendor for future growth as proof-of-concept offerings emerge. Some examples: A number of major hardware makers and world operators are organizing discussions around interoperability. Here's media coverage of the effort: http://www.virtualworldsnews.com/2007/10/ibms-peter-hagg.html And here's a list of participants: http://vwinterop.wikidot.com/oct-9th-attendees Samsung is seeking researchers for interoperability initiatives: http://www.virtualworldsjobs.com/a/jbb/job-details/13776 Anshe Chung has announced an initiative on currency exchange across virtual worlds: http://acs.anshechung.com/news_4.php EMERGING PROVIDERS AND OPPORTUNITIES Here's one company in particular that is likely to have resources for infrastructure investment and a fast-growing MMO product. MindArk (http://www.mindark.com), publisher of Entropia Universe, has just announced plans for a public offering: http://www.mindark.com/docs/pr/MindArk_Intends_To_Go_Public.pdf MindArk is based in Sweden, and its Entropia world is known for operating a cash economy. MindArk is planning to launch a similar virtual world in China that some industry observers believe could rapidly gain a huge user base. Here's the company's announcement: http://www.mindark.se/docs/pr/Entropia_Universe_Enters_China.pd f Dan Miller, a Senior Economist for the House Joint Economic Committee who tracks government's role in virtual worlds, predicts the Mindark China project will be significant: "The virtual world that MindArk is developing for China, set to launch next year, could shake up the industry as it has the potential to quickly become the biggest single virtual world in operation. Miller told Virtual World News. "Whereas Second Life typically hosts around 40,000 residents simultaneously, this new Chinese virtual world promises an eventual capacity of up to 7 million simultaneous users. Even if it falls well short of its projections, it would still have an enormous population. Such a large concentration of users will influence what businesses and software developers focus on (e.g., if a developer can only design an application for one virtual world, the largest world would be an attractive choice)." |

Where To Sell Hardware For The Online Gaming Market? by Peter Van Dyke

Where To Sell Hardware For The Online Gaming Market? by Peter Van Dyke

Saturday, December 29th, 2007 @ 3:31PM

Some thoughts about this list: There are a lot of games on here that have millions of players. Ragnarok has close to 25m, World of Warcraft has almost 10m, MapleStory is reported to have nearly 50m. The trend here is that MMOGs, currently, are much more popular in Asia than they are in western countries. This may change, and World of Warcraft is a good example, but currently there are a significantly higher number of MMOG players in Asia than in The United States or Europe. Keep this in mind. Regardless, the two big players to watch over the next several years are going to be EA (Mythic), and Activision Blizzard. They are the Western MMOG Titans, and they are the companies that are looking to dominate the western MMOG market.

As far as players in the hosting market, there are already some very large companies with strong footholds. AT&T (World of Warcraft, most of Sony’s MMOGs), IBM (EVE), and Valve Software (Everything available on Steam) are all significant players, and their market capitalizations are equally very large. These companies provide hosting packages, support and sometimes hardware (IBM) for the developers/publishers. AT&T has an entire business unit devoted to MMOG hosting. What these companies do is have large localized datacenters with the ability to host multiple MMOGs per center, allowing them to host localized content for developer/publishers all over the world. In some cases they develop and implement entire clusters for a single game, as is the case with IBM and EVE. There are other players: Earlier this year Global Netoplex acquired Online Game Services Inc in order to consolidate and better compete with the larger players. They host several casual websites, and will be providing hosting for the multiplayer aspects of the Hellgate: London.

In conclusion, I would focus on those three words: Flexibility, Localization, and Expandability. Flexibility: Be able to work with your clients every step of the way, provide great support and assistance in the design of the infrastructure, taking into account the software that your client intends to run – in fact, understand the software from beginning to end, and determine the hardware requirements from there - and make sure you do not segregate yourself into one market – be flexible about what you can provide. Localization: To be truly successful, you are going to want to be able to work in many different regions. This might not be possible depending on how much capital you have, but it is a consideration, given than the Asian MMOG market is currently so much significantly larger than the Western MMOG market. Expandability: Make sure that your hardware takes into account the aspects of the server code and provides enough headroom or interoperability that expandability is not a problem.

|

Peter Van Dyke Sun Dec 30 4:52pm |

A clarification: Activision Blizzard is the combination of Vivendi Games, of which Blizzard was a part, and Activision. Vivendi announced a merger on December 2nd, and expect the process to be complete by mid-2008. Vivendi will own between 52% and 68% of the company, and the new name of the company (which includes all of the developers under the "Vivendi Games" name and all of Activision) will be Activision Blizzard. |

|

Peter Van Dyke Mon Dec 31 8:59pm |

Additional thoughts: There are several additional thoughts about flexibility, which I believe to be the most important of my points about strategy, that I didn't include in my original insight, which I believe to be of enough importance to tack them onto the end. So let's go back to flexibility. When you're designing hardware for a specific application, it's easy to do - the problem is, as I mentioned, that each client is going to have a different set of requirements to match their software. When you're trying to break into a specific subscriber-level of the market (say either 1m), you are going to need to have significant flexibility in what you can provide to your clients. It is also very important to understand that the number of subscribers does not necessarily translate into required performance. The design of the software back-end is very much the deciding factor in how much performance is required for a given, connected subscriber. Bandwidth will remain largely unchanged from game to game, and unless you are interested in breaking into the hosting market, network latency is not going to be a large consideration as long as you ensure that your hardware can keep up with your client's software performance requirements. When you're looking to break into this market, I would suggest looking at trends on the design side as well as currently popular games. For the sake of this argument, we will be considering EVE as a current-gen title (player-to-player interaction through a system) and World of Warcraft as a title that is a half-generation step back (player-to-system interaction through a system, with additional player-to-player elements). When I say player-to-player, I mean that the majority of the gameplay consists of player interaction with other players - this includes dueling, and every abstraction therein: skirmishes, battles, and even wars taking places between players and player-deliniated organizations. The reason that I bring this up is because it often necessitates a different type of system design - this type of system is benefited significantly by the addition of new players and a very large player base. This is precisely the reason the realm utilized by Western players of EVE has only one world - every player in the Americas/Europe plays in the same EVE universe. This type of system requires a very powerful and likely distributed computing network, instead of a set of many physical servers each running a different player world or realm. This can also be see in how Blizzard regulates Battlefields in World of Warcraft - while all players play on specific realms, and do not interact with other realms, Battlegrounds are player vs player environments that are accessible from any realm. This means that players that normally would not interact can be in the same environment, working together or against each other. The large number of available players (effectively all players on all realms) creates a highly diverse population of players, benefiting the system directly. Essentially, I believe that after the next generation of MMOGs come out - this includes new games from EA/Activision Blizzard - we will begin to see much more player-to-player oriented games emerging in every subsequent generation. Because this type of MMOG benefits so naturally from a large number of available players, large-scale distributed computing clusters each running a game world will become more prevalent. But that is the future. For the time being, MMOGs are heavily system-based in their design. And will continue to be for (at least) one more generation. Because this is the case, the per-server processing requirements will remain high, and power consumption as well as cost will be of less importance than they will in the future. As this is the case, it would be of significant benefit to have expertise in both areas, as it will provide for you an entrance strategy and a further expansion strategy. If companies that are currently building system-based games find you reliable and reasonably priced, it is more likely that they will come to you when they are looking to buy a large amount of hardware for a future, single- or multiple-server cluster. Some thoughts about where to position yourself geographically: If the capital is there, it would be ideal to position yourself in both the US and Asian markets, as the US market is poised for explosive growth in the short-term, and the Asian market has a significant amount of existing and future growth potential. However, I believe that the Asian market is ahead of the US/European market in terms of cultural acceptance and recognition of this type of game. The combined population of subscribers of MMOGs in Asia is several times larger than that of the United States, even while taking into account the population difference. Additionally, the industrialization of China has and will continue to open up whole populations of possible (and likely) computer/internet-literate subscribers in the 12-26 age range. If you wish to target small, emerging MMOGs, I believe that it is even more beneficial to target the Asian market: The Korean and Chinese populations are significantly more acclimated to MMOG culture than the Western population. This is changing, but currently there are significantly more liquid MMOG subscribers that would be interested in playing (and even purchasing) a new, unknown but "good" MMOG. Thus, it is more likely that a small, unknown MMOG will gain traction in the Asian market than in Western market. If you wish to target well-established MMOG production companies such as EA and Activision Blizzard, the western market should be taken into strong consideration, but the Asian market should still not be ignored. Essentially, no matter which type of MMOG developer/publisher you wish to target, the Asian market can not be ignored. It has the largest current MMOG subscriber rates AND the largest upside growth potential. With more than 1b people, of which nearly 23% are between the ages of 15 and 29, China represents the largest single viable MMOG-playing population of any country in the world. Additional Sources: http://www.britannica.com/wdpdf/China.pdf http://www.stats.gov.cn/w as40/gjtjj_en_detail.jsp?searchword=population&channelid=9528&record=6 |

|

Peter Van Dyke Mon Dec 31 9:00pm |

As I neglected to include a significant number of my sources in the first part of my insight, here are the important ones: MMOG Subscription Data: http://rpgvault.ign.com/articles/748/748331p1.html http://gamestudy.or g/eblog/?p=32 http://www.gamespot.com/pc/rpg/swordofthenewworld/news.html?sid=6 170306&om_act=convert&om_clk=newsfeatures&tag=newsfeatures;title;3 http://www.jagex.com/corporate/Press/pressRelease.ws Additional, face-to-face conversations with: - Two Designers on World of Warcraft at Blizzard - One Executive Producer at EA |

Where To Sell Hardware For The Online Gaming Market? by Michael Ho

Where To Sell Hardware For The Online Gaming Market? by Michael Ho

Sunday, December 30th, 2007 @ 9:37PM

|

Joseph Hunkins Tue Jan 1 12:55am |

This is excellent Michael. You did a good job pinning down the tricky server numbers for the companies, though I'm skeptical of the 15k servers for Second Life. If true that would appear to place them among the top in terms of infrastructure if Shanda also has 15k and Giant has only 1600 or so, which seemed low. |

|

Case Sponsor Michael Ho Tue Jan 1 2:41pm |

Hi Joeduck, I agree that 15,000 servers sounds like a pretty high number, but I suspect that they're counting "low quality" servers. Just as Google started off using a massive array of cheap servers, I'd guess that Linden Labs is compiling a "Frankenstein" cluster of old hardware -- if this number is accurate. If my guess is right, then Linden Labs may be dealing with how to replace servers as they die off -- similar to how Google has created a storage database system that is fault tolerant. However, this is just my speculation. |

|

Case Sponsor Michael Ho Tue Jan 1 3:42pm |

heh. or scratch that. IBM has stated it is investing $100 million in Second Life. http://content.techrepublic.com.com/2346-3513_11-37111.html http://blogs.techre public.com.com/tech-news/?p=1369 And it looks like IBM may be stepping in to help Linden Labs stabilize its server infrastructure. http://www.secondlifeupdate.com/2007/12/12/linden-labs-cto-fire d/ http://games.slashdot.org/article.pl?sid=07/10/11/1530206 Joshua Linden has also posted some of his server troubles. http://blog.secondlife.com/2007/11/13/second-life-1185-server-deploy- post-mortem/ http://www.massively.com/2007/11/13/joshua-lindens-post-1-18-5-ser ver-deployment-post-mortem/ |

|

Peter Van Dyke Tue Jan 1 11:03pm |

There's some great stuff here Michael. You hit on a couple of really interesting points about possible strategies: The concept of partnering with ISPs to provide good-quality and value for MMOG developers is a great one. If the company can break into that market and make it apparent that they really have the staying power and the expertise to be reliable and perform, having partnerships with ISPs around the world could give it a significant advantage through a little old-fashioned vertical integration. Lower prices, better value. One person to hire for a developer/publisher, instead of several different bills per MMOG. I'm not sure about the viability of trying to provide more secure authentication though. It seems like it would be a little intensive to create an authentication back-end that is flexible enough to be used across multiple platforms. The only option would be to use some form of Trusted Computing. That thought it a little depressing though. Providing a service to free or low-cost MMOGs and Open-Sauce MMOGs is a great idea. It will increase knowledge of the market and thus increase the possible subscriber population. This is good for the hardware manufactures as well as the software manufacturers, and if it can be done at least relatively efficiently it could be fantastic. If the curious company is able to create a stable, powerful server with a set of basic tools developers could use to host their games, they might be able to create a standard for these games. If it becomes popular enough, it might even have enough traction to move into the commercial space too - this could be a huge boon for the hardware company. |

Where To Sell Hardware For The Online Gaming Market? by todd lyden

Where To Sell Hardware For The Online Gaming Market? by todd lyden

Monday, December 31st, 2007 @ 8:01AM

The questions asked are broad and tough to get a handle on without some specifics, but broadly, DFC Intelligence addresses much of this:

“However, all these companies have been very regionally focused on Asian markets. Global reach is key and the Asian game companies have yet to prove they can have successful long-term expansion outside their domestic market.

As a result, the stock price of Asian online game companies has fluctuated significantly over the past three years. As the charts show, in that time period, none of the Asian companies have had anywhere near the upside of the top traditional video game companies.” (Shanda (SNDA); The9 (NCTY); Netease (NTES))

Source: http://www.gamasutra.com/php-bin/news_index.php?story=16690

“Graphics aren't everything. Free is the best price. Chat is one of the most important part of MMO game design.”

“As the concept of free-to-play games gained popularity among the web-savvy teen and 'tween markets, 2007 saw an explosion in 'garage-coded' games going big-time. Maid Marian's Sherwood Dungeon might the most noteworthy of these games, all done done on the cheap, in Flash, and hitting huge numbers of players.

This was also the year that saw virtual worlds hit the big time. Whether we're talking about the over-hyped Second Life, the announcement of Metaplace, or the under-rated Club Penguin, social online experiences have definitely become front-page news. Killer apps like Webkinz and BarbieGirls pushed the folks who wouldn't necessarily identify with swords and sorcery into an avatar, and primed them for future (subscription-based?) online exploits.”

Source: http://www.gamasutra.com/php-bin/news_index.php?story=16758

In terms of hardware, the companies that exist are there:

“GNi Inc. (http://www.gni.com), formerly Global Netoptex, a leading provider of customer-centric managed hosting services, announced today that the company has been named to Inc. Magazine’s Inc. 500 list of the fastest-growing private companies in the United States, ranking #8 in California, #38 among all U.S. IT services companies, and #349 overall on the prestigious annual list, based on a stunning three-year revenue growth rate of more than 792 percent.

“GNi continues to record outstanding customer growth and soaring revenues," said Derek Wise, GNi president and CEO, “and our performance has now been internationally recognized by receiving the Inc. 500 award. Today, with more than 400 customers, 100 percent annual revenue growth and operations in key markets worldwide, we are keeping our promise to execute on our global expansion plans designed to allow our clients access to high-quality solutions."

Founded in 2002, GNi has 14 service locations across the United States, Europe and Asia. It provides a range of products and services including managed internet, managed servers, storage and back-up, security and facilities services for companies across many industries and technology sectors.”

Source: http://www.newgengamers.com/index.php?option=com_content&task=view&id=92 6&Itemid=114

“IBM has announced that MMO game companies CCP Games (Eve Online), Codemasters (Colin McRae Rally series), Icarus Studios (Fallen Earth) and Cheyenne Mountain Studios (Stargate Worlds) have chosen IBM's BladeCenter and System x servers for their online games.

In particular, CCP Games has deployed a cluster of more than 420 CPU cores housed in IBM System x and BladeCenter servers, helping it to scale for rapid growth - since its 2003 launch, EVE Online's subscriber base increased to more than 200,000 players in only four years. IBM says CCP's supercomputing cluster manages more than 150 million daily database transactions.

As for Codemasters, the England-based company deployed IBM BladeCenter systems as their hosting platform for The Lord of the Rings Online and RF Online. For example, RF Online connects gamers 6,000 miles apart across two continents through its hosting infrastructure remotely managed from Boston.

Icarus Studios' licensee Fallen Earth, a post-apocalyptic future MMO currently in development, will also run on IBM BladeCenter, IBM System x and IBM System Storage.

Cheyenne Mountain Entertainment, based in Mesa, Arizona, is building its first online RPG around the Stargate franchise, and deployed IBM's System x3800 servers to develop, test and support the effort.

"We were pleased with the breadth of expertise and experience IBM brought to help us build our MMOG solution," said Joe Ybarra, senior vice president of Strategic Operations, Cheyenne Mountain Entertainment. "We selected IBM servers that offered the best combination of uptime, performance and expandability to meet the needs of Stargate Worlds."

Source: http://www.gamasutra.com/php-bin/news_index.php?story=15130

Getting married to a particular platform isn’t necessary either: while Shockwave is in decline, it isn’t dead: “Maid Marian utilizes Shockwave for all their games. And Gene says that while Shockwave has just 55% penetration among the general populace (and Shockwave installations are declining), his market - teens - sees about 80-85% Shockwave penetration.Maid Marian is grossing approximately $700-$800K/year, with 50% of that number being reinvested into the business.”Source: http://freetoplay.biz/2007/07/11/10-things-you-didnt-know-about-the-most-success ful-shockwave-mmo/

But Flash is going to end up probably dominating the market:

http://www.gamasutra.com/php-bin/news_index.php?story=14604

Some companies to look at for future development:

Funcom

http://en.wikipedia.org/wiki/Funcom

ftp://ftp.funcom.com/investor_relations/repor ts/070726-Q2-presentation_FUNCOM.pdf

http://64.233.169.104/search?q=cache:nFj9NyW wetAJ:www.warcry.com/news/print/78775+ip+soft+funcom&hl=en&ct=clnk&c d=6&gl=us

red 5 studios

http://online.wsj.com/public/article/SB118071923725321635.html?mod=sblink _past_reports

Mythic

http://en.wikipedia.org/wiki/Mythic_Entertainment

http://www.mythicentertai nment.com/

Vigil

http://en.wikipedia.org/wiki/Vigil_Games

Nexon

http://en.wikipedia.org/wiki/Nexon

http://company.nexon.com/english/

DFC Intelligence is probably the best source and indicator for overall approach:

http://www.dfcint.com/game_article/jan07article.html

Even going so far as to have developed a conference:

“In April, DFC Intelligence will be partnering with Flybug Media to present ‘Mastering the Craft of Online Gaming Infrastructure.’ This one day event, to be held on April 19, 2007 in San Francisco, will bring together some leading industry veterans to discuss best practices for operating online games. For more details visit http://www.masteringthecraft.com/.”

Source: http://www.dfcint.com/wp/?p=4

Perhaps the single best piece of advice:

Look to Funcom’s model (http://64.233.169.104/search?q=cache:nFj9NyWwetAJ:www.warcry.com/news/print/787 75+ip+soft+funcom&hl=en&ct=clnk&cd=6&gl=us)

They recognize the global differences and recognize the need to address the differences with technology as well as the product itself.

While niche markets do develop, it doesn’t mean they can’t be exported, but the technology must be present to accommodate.

Where To Sell Hardware For The Online Gaming Market? by Alex Fletcher

Where To Sell Hardware For The Online Gaming Market? by Alex Fletcher

Monday, December 31st, 2007 @ 12:54PM

|

Alex Fletcher Mon Dec 31 12:56pm |

where is my insight? |

|

Case Sponsor Michael Ho Mon Dec 31 6:32pm |

hi alex, We've received your Insight, and we're working on re-formatting it. Thanks for your submission! Michael Ho |

Where To Sell Hardware For The Online Gaming Market? by Daniel B

Where To Sell Hardware For The Online Gaming Market? by Daniel B

Monday, December 31st, 2007 @ 4:03PM

Note: In addition to the sources referenced below, interviews were conducted with:

a) The CEO of the largest MMOG-focused hosting company in North America (with additional operations in Europe, Australia, and Asia)

b) The Director of Service and Support for an MMOG-focused managed services company based in North America (with operations in Europe, South America and Africa)

MARKET OPPORTUNITY

The MMOG market is expected to double in the next five years. MMOGs differ from typical computer games because they are perpetual virtual worlds, meaning that users can continue to play forever building on previous play. New players are constantly starting to play these game and continue playing them, creating a snowballing user base.

Traditional game developers are beginning to discover a new sources of revenue from MMOGs. The developers typically offer a free version or trial period to attract users, and then a subscription-based version (typically $10-$20/month) to keep the on going revenue stream. In the future, MMOGs are likely to generate additional revenue through advertising and non-traditional revenue sources such as virtual sale items.

Overall, DFC Intelligence estimates the market will double by 2012, reaching $13B worldwide. Half the revenue will come from East Asia, 25% from North America, and the remainder from Europe and Japan.

MAJOR GAME OPERATORS

The 15 largest MMO Games are as follows:

MMOG

PUBLISHER

GEOGRAPHIC FOCUS

1. World of Warcraft

Blizzard

Half of users in China

2. Habbo Hotel

Sulake

Europe

3. Westward Journey

NetEase

China

4. Second Life

Linden Lab

Global

5. Guild Wars

NCSoft

N. America

6. Knight Online

Mgame

N/A

7. Dofus

Ankama

France, Global

8. Lineage

NCSoft

Korea

9. Lineage 2

NCSoft

Korea

10. RuneScape

Jagex

N. America, Europe, Australia

11. Club Penguin

New Horizon Interactive

N. America

12. Webkinz

Ganz

N. America

13. Gaia Online

Gaia Interactive

N. America

14. Fallen Sword

Hunted Cow Studios

N/A

15. Entropia Universe

MindArk

Global

Of these fifteen MMOGs, the fastest growing (based on 2006-2007 subscribers) are:

Additionally, the following venture-backed MMOG developers are likely to launch in the next 1-2 years:

MMOG HOSTING and IT REQUIREMENTS

Leading MMOG Hosting companies:

Additional hosting companies used by MMOGs:

Most game developers do not have the capabilities to host games themselves. Rather, they rely on outsourced MMOG hosting services. Even the largest MMOG developers such as Blizzard, Activision and Electronic Arts use third party MMOG hosting services.

Whether an MMOG game developer is hosting a game in-house or outsourcing it to a hosting company, the following three issues are most important in selecting IT vendors:

The largest IT vendors for the MMOG market are IBM, HP, and Dell.

BREAKING INTO THE MMOG MARKET

There are two approaches that will enable an IT vendor to break into the MMOG market.

1) Target both large MMOG developers that do their own hosting and also outsourced MMOG hosting companies. To avoid competing on price, focus on system stability, scalability, and management tools that can support the MMOG environment.

2) Consider providing heavily discounted equipment for use in the development stage. Historically, MMOGs could be hosted on any vendor's hardware, but as developers seek to increase system stability they are increasingly becoming platform dependent. This means that if an MMOG developer uses a specific vendor's hardware for development and testing, they are likely to request the same vendor's hardware for hosting.

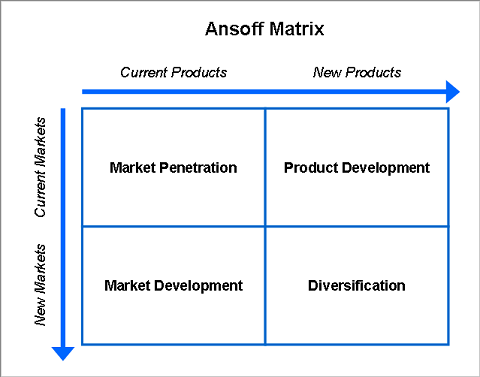

In order to assess exactly how a company can enter this market, it is necessary to understand how the company is currently positioned. The Ansoff matrix provides a basic framework to understand what type of entry is needed - based upon a company's product portfolio and market space.

A go-to-market strategy required for a Market Development play is quite different from those required for a Product Development play, and different still from Diversification.

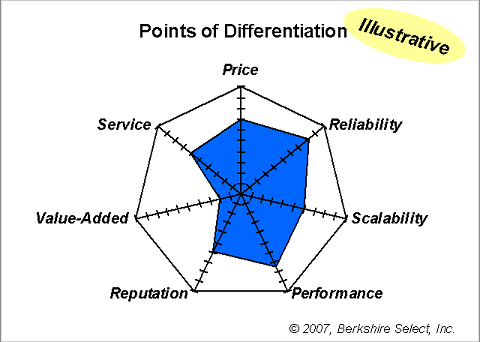

One of the immediate next steps to take will be to benchmark your company's current status along key dimensions. Using a "Points of Differentiation" graph, it is possible to tailor the go-to-market strategy to take advantage of the company's strengths.

In the example above, a company may be strong in performance, reliability, average in scalability, reputation, service and price, and weak in value-added services. After analyzing other IT vendors using a similar framework, a company with these particular points of differentiation might choose to focus on midsized MMOGs with 100k-200k subscribers.

Further information about the client's situation is required to do a proper assessment.

ABOUT THE AUTHOR

Daniel Berch is a strategy consultant, focusing on issues related to growth and innovation. He is editor of the blog "Strategy Is Everywhere."

Daniel can be reached for comment at dberch@aroint.com

SOURCES

MMOG Data

http://mmogdata.voig.com

DFC Intelligence - Online Game Market Forecast

http://www.dfcint.com/game_article/may07article.html

IGDA (International Game Developers Association) - Hardware and Hosting

http://www.igda.org/online/quarterly/1_3/persistenthw.php

GigaOM Top 10 Most Popular MMOs

http://gigaom.com/2007/06/13/top-ten-most-popular-mmos

MMORPG Developer's Forum

http://mmorpgmaker.vault.ign.com/phpBB2/index.php

FURTHER READING

IDC - ASEAN Online Gaming 2007 - 2011 Forecast and Analysis

http://www.idc.com/getdoc.jsp?containerId=AP3221S4P

IDC - China Gaming 2007-2011 Forecast and Analysis

http://www.idc.com/getdoc.jsp?containerId=CN656102P

IDC - India Online Gaming 2007–2011 Forecast and Analysis

http://www.idc.com/getdoc.jsp?containerId=AP3221SSP

|

Daniel B Mon Dec 31 4:15pm |

The table of largest MMOGs did not show up correctly. Please go here for a readable version: http://strategyiseverywhere.files.wordpress.com/2007/12/mmog-list.pn g |

|

Peter Van Dyke Mon Dec 31 7:19pm |

Based on my research, your chart of the largest MMOs is very inaccurate. Several sources place Maplestory and Ragnarok very far ahead of World of Warcraft in terms of total number of current subscribers globally: http://gamestudy.org/eblog/?p=32 http://rpgvault.ign.com/articles/ 748/748331p1.html I think that it is necessary to take into account the segregation of Asian/Western markets more than you do in your post, as the vast majority of subscribers/subscriber growth (in terms of additional subscribers) and bandwidth/hardware requirements is being seen in Asia. If a company is going to position itself in the manner you suggest, it would be beneficial to take a long look at the available markets, and pick one. In this case, if a company wishes to position itself to break into the 100-200k subscriber MMOG market, it would be beneficial for the company to enter the Asian market, as the culture is significantly more acclimated to Massively Multiplayer gaming, and therefore holds a significant possible short-term growth advantage when compared to the American/European markets, which are still becoming fluent in this cultural medium. I agree with your suggestion that the company position itself to provide heavily discounted product to emerging players in the market. Because hosting/MMOG companies tend to expand with popularity and publicity, as long as a given platform and its producer (company) have been reliable, they will continue to stick with that company unless there is a significantly cheaper AND better performing alternative. See Intel vs. AMD. Interestingly, I think that single-box performance is often over-estimated in terms of its importance to a buyer in this market. In some cases, such as World of Warcraft, several general player realms are hosted on each server, and instanced play is hosted on an entirely separate set of servers. In this case, per-box performance is important. However, it should be taken into account that companies such as CCP (EVE) as well as Google utilize relatively low-power single boxes that are networked to provide a significantly higher amount of overall performance. This, I believe, will be the continuing trend as companies begin to follow in CCP's footsteps (in terms of creating single realm systems on which all players in a given region are playing together) - this will be more apparent as companies begin to focus their game designs around player-player interaction instead of player-system interaction. |

|

Daniel B Wed Jan 2 9:46am |

Dear Peter, Thank you for the comment. I compiled the list of MMOGs from the two best sources available: the GigaOM technology research/analysis blog, and MMOGData, which is the most comprehensive source of information on the MMOG market. I agree that the two games you mentioned should be added to the list, however I think you might be confused about how they stand compared to World of Warcraft. As a still-nascent industry, the MMOG market has not yet standardized the metrics it uses to track subscribers/users/etc. Nine million paying subscribers is very, very different than twice as many free users. Further, for older games, total users may not accurately portray "active users." World of Warcraft currently has nine million people who are currently paying a subscription fee. Maplestory and Ragnarok are nowhere near that level. Best, Daniel |

|

Peter Van Dyke Thu Jan 3 3:52pm |

Daniel, I agree that a paying subscriber and a free subscriber are different. However, in this context, considering "active" subscribers - ie subscribers that do log into and spend time in the game - is more important than just considering paying subscribers. Active subscribers and paying subscribers, in any context, require the same hardware and resources in a given game. In fact, the only difference between the two is how they are a source of revenue. World of Warcraft recoups incurred costs by requiring that users pay subscription rates, or, in East Asia, by requiring that users pay for play time directly. Maplestory recoups costs through microtransactions - players have the ability to play the game for free, but a significant number choose to purchase add-ons for their characters. Both paying and active subscribers log into the service and play the game, therefore requiring nearly the same resources. In fact, to ignore an active subscriber simply because he/she does not pay a monthly fee to play a game is to alienate the vast majority of MMOG players, and indeed a huge slice of the MMOG market. You wouldn't disregard Counterstrike or Team Fortress just because the players do not pay a monthly fee to play the game would you? Would you disregard Gunbound because it's free to play but costs money to upgrade your avatar? All of these games require servers and development, and simply because players do not pay a monthly fee for their service does not mean that they are suddenly less important or less intensive. In conclusion, the numbers that I quoted were free, active subscribers. This is not the same as total registered accounts. These are people who participate in the game world. I will agree that to get someone to pay for a game monthly means something, but in this particular context, talking about users should include both active players who do pay for game time and active players who do not. The market is much larger than Runescape (which does have a free option) and World of Warcraft, and alternative business models within the MMOG space need to be considered. Cheers, Peter |

|

Daniel B Fri Jan 4 11:48am |

Peter, Good thoughts... however the real metric to focus on is not number of users (paying or otherwise) - rather, it is the *amount* of usage (i.e., concurrent usage) that determines IT hardware requirements. The research I've seen suggests that paying users trend towards having higher usage (but this varies by game). For anyone still following the thread, the upshot is this: user and usage metrics are non-uniform in this nascent industry, hence it's better to start with a longer list of MMOGs and conduct primary research to evaluate their actual needs. Happy new year, Daniel |

Where To Sell Hardware For The Online Gaming Market? by Joseph Hunkins

Where To Sell Hardware For The Online Gaming Market? by Joseph Hunkins

Monday, December 31st, 2007 @ 11:37PM

Major Companies:

Blizzard (main game - World of Warcraft)

This month brought the merger of Activision with Vivendi owned Blizzard. Blizzard, with World of Warcraft, is arguably the key player in the online gaming space because World of Warcraft is the world's largest multiplayer online game with some 9 million subscribers. World of Warcraft has a long history of innovation in the gaming space, a huge community of players and enthusiasts, and is showing signs of making a mark in the world's largest potential gaming market of Asia via licensing of the World of Warcraft franshise to China's The9 (for The9 info see below).

The new merged company is Activision-Blizzard with a potential market capitalization of over 18 Billion US by these terms, which are subject to SEC approval:

Vivendi to Contribute Vivendi Games Valued at $8.1 Billion, Plus $1.7 Billion in Cash in Exchange for

approximately 52% Stake in Activision Blizzard at Closing; Total Transaction Valued at $18.9 Billion

Vivendi Games Contact Information:

USA: 6060 Center Drive

5th Floor, Los Angeles, CA 90045

USA

Tel. : +1 310 431 4000

France: 9-11 rue Jeanne Braconnier

Immeuble Le Newton

92366 Meudon-la-forêt

France

Tel : +33 1 46 01 48 00

NCSOFT (main game - Lineage II)

NCSOFT is a key player in the Asian Online Gaming space, producing and hosting the game that is very popular in Korea but not in the USA: Lineage II. NCSOFT's market capitalization is approximately $1 Billion US. This capitalization is approximately half of NCSOFT's value of a year ago and by some indications the company is struggling to regain prominence, probably in the face of increasing competition from the China companies listed below. In a recent case study [ http://download.microsoft.com/download/3/7/3/373D4885-9144-466B-895C-D6712B8D376 8/NCsoft_case_study.pdf ] Microsoft reported server specs for NCSOFTs Lineage II upgrade: Microsoft reports that NCsoft has migrated to 64-bit computing for Lineage II: Chronicle 4, running the game on Windows Server 2003 Enterprise x64 Edition. Unfortunately they do not cite the number of servers, but it seems reasonable to assume that Lineage would run in the neighborhood of at least 10,000 servers given Shanda's 11,000 servers that were running in Dec 2004 (BusinessWeek).

NCSOFT:

157-33 Oksan B/D, Samsung-dong,

Gangnam-gu, Seoul,

South Korea (ZIP 135-090)

+82-2-2186-3300 webmaster@ncsoft.net

http://ncsoft.com

Linden Lab (Second Life)

Linden Lab operates the Second Life virtual online environment. They are in the process of scaling from 2000 servers to 10,000 according to a March 2007 Business Week Article.

Linden does not share some details of their operations, and as a private company it is not clear what the value of the company would be on the open market. However it's clear Second Life is very profitable and poised to grow in popularity, especially as businesses seek "islands" to promote their goods and services to the growing number of Second Life participants. These Second Life Islands are usually in the form of a dedicated server so there is opportunity here to work with Linden to optimize the new server environments to their specifications.

Linden Lab

945 Battery Street

San Francisco, CA 94111

Major MMO Companies in China:

The 2007 China MMO game market is approximately $1.6 billion, some *four times* larger than the China search market and growing at an annual rate of about 35%, suggesting that gaming will continue to eclipse search in importance for some time. This is conspicuously different from the US market where search advertising is far more significant, and dominated by Google.

The following four key players control 61% of the Chinese Massively Multiplayer Online market (Source for this and 1.6 billion market estimate is Seeking Alpha article cited below).

SHANDA Interactive Entertainment

Symbol SNDA, Market cap $2.37 Billion US

Shanda is a key player in the space of online gaming in China and does development and operation of online gaming including MMORPGs and casual games.

A December 2004 Businessweek article noted that Shanda operates 11,000 servers around China but I could not find a more recent server estimate.

Shanda Interactive Entertainment Ltd.

No 1 Intelligent Office Building No 690 Bibo Road

Pudong New Area

Shanghai, 201203

Phone: 86 21 5050 4740

Fax: 86 21 5050 8088

http://www.shanda.com.cn

GIANT Interactive Group

Symbol GA, Market Cap $3.4 Billion US

Giant operates MMO games in China that are not known well or popular in the USA. |

These are ZT Online , ZT Online pay-to-play and Giant Online. Giant has a game called "K III" in development.

Giant Interactive Group, Inc.

2nd Floor No 29 Building

396 Guilin Road

Shanghai, 200233

Phone: 86 21 6451 5001

Web Site: http://www.ztgame.com.cn

NETEASE

Symbol NTES, Market Cap $619 Million US.

Netease business is focused primarily on aquiring MMORPGs players with prepaid "game play" cards that are distributed via wholesalers, cafes, and software stores.

Netease.com Inc.

SP Tower D 26th Floor Tsinghua Science Park Building 8

No 1 Zhongguancun East Road Haidian District

Beijing, 100084

Phone: 86 10 8255 8163

Fax: 86 10 8261 8163

http://corp.163.com

THE9 Limited

Symbol NCTY: $516 Million US

The9 Limited

690 Bibo Road

Zhangjiang Hi-tech Park

Shanghai, 201203

Phone: 86 21 5172 9999

Fax: 86 21 5172 9500

http://www.the9.com

The9 - http://www.corp.the9.com - could have influence beyond their lower market capitalization than larger players because they now license rights from Blizzard to operate World of Warcraft and arguably may have the most growth potential since World of Warcraft is the biggest game in the world by far, and China is potentially the biggest market foronline gaming with a population greater than Europe and North America combined.

China's SINA, with a 2.35 Billion market capitalization (http://www.sina.com) also operates some gaming environments but it appears to be a smaller component of their very diversified internet offerings.

The Market for Gaming Servers and Gaming Infrastructure:

The China and Asia markets appear to have explosive income growth potential, but this has not clearly materialized for all the major players over the past few years. NCSOFT is almost apologetic in the latest report to shareholders, suggesting that high development costs and long development cycles have kept profits down. NCSOFT's share price has fallen some 50% in the past year.

So, though the gaming server market may be potentially lucrative I think some important caveats are in order as you examine the potential growth in the global server gaming markets:

1) Console gaming, largely controlled by the major players such as Microsoft, Nintendo, and Sony, is moving powerfully into the multiplayer online environments. This is likely to inhibit / displace the growth of purely online multiplayer gaming although it may open opportunities to partner with those large key players for server infrastructure.

2) Innovations *may* allow game server farms to push more of the server load to local machines, though based on my research there is NOT a movement in this direction at all. However I'm not familiar enough with game program nuances to know if this is a realistic concern. On the upside, generally the game "worlds" are hosted remotely and use most of the servers and bandwidth so this aspect of the game is unlikely to be localized. On the broader internet landscape things are increasingly run on remote servers and not locally (e.g. email, Google docs, mashup websites, etc). This trend may bode well for increasing game infrastructures.

3) Virtualization: A march report by IDC suggests that virtualization via multicore will create over 4x the number of virtual servers as real ones with some potentially disruption of existing markets:

number of virtual servers will rise dramatically at a compound annual growth rate of 40.6 percent by 2010. By the end of the forecast period, then, more than 1.7 million physical servers will be shipped for virtualization activities resulting in 7.9 million logical servers

Source: http://www.newsfactor.com/news/Virtualization-Stealing-Server-Sales/story.xhtml? story_id=110000CTRSM2

4) Dispersion of servers over thousands of hosting services and Gaming Server Providers. For games like Counter-Strike it may be difficult to approach all of the server locations since they are so distributed. For this reason it may be best to work with and partner with Valve to determine ideal configurations and have them help put a "stamp of approval" on your proposals to the large hosting companies like Counter-Strike and Nuclear Fallout.

NCSOFT's annual report has some excellent projections and global gaming market information:

http://www.ncsoft.net/global/ir/download/IR_Report_Eng(FY2007)-Novem ber.pdf

For an interesting snapshot of several existing games and their market share through mid-2006 see this chart: http://www.mmogchart.com/ (click on 120,000+ subscribers): Note however that current use for World of Warcraft shows about 9 million subscribers. Lineage II has conflicting reports of usage and trends, but 1.5 - 2 million subscribers seems a reasonable subscriber base number and 10,000 servers a good working estimate based on Shanda's reported 11,000 servers.

Strategies to play a major role in the gaming market:

The merger of Blizzard and Activision offers a superb opportunity to bring new innovation and ideas to the "new" company that will be by far the key player in the online gaming space for some time to come. As the producer of World of Warcraft as well as several other popular games, and as the licensor (to The9 of China) for World of Warcraft in China, Activision-Blizzard is *the* customer you want to have and to hold in this space.

Consider working to develop partnerships with the big player game developers like Blizzard, NCSOFT, and even Valve as well as approaching other major game hosting providers. In the case of NON-MMORPG server sales to large hosts, it may help to have Valve or Counter-Strike "endorse" your servers as "counter strike optimized" for their games and promote them to the hosting providers like Rackspace.

Establish a close working partnership with the companies that are providing the *game specifications* now and likely into the future. Note that major players like Blizzard and NCSOFT have been around for some time. You want them to help define your product so it is perfectly optimized to their changing specifications and needs. In terms of NON-MMORPG convincing the game company that you are the key quality providers in the server and infrastructure space is likely to be a stronger marketing tactic than trying to convince hosting services to buy servers for gaming applications. Presumably those hosts will want to follow the recommendations of key gaming environment providers like Valve.

For your main business target - the MMORPG companies like Linden, NCSOFT, and Shanda that run their own server farms you'll want to concentrate on establishing a superior quality relationship such that you meet their needs on time and with top level support. Creating a "game informed/ game optimized" division would likely help, because you do not want the game companies to have to explain *anything* but basic configuration issues to your staff. Gaming infrastructure is not the same as some other environments, so your sales staff should be very adequately prepared and knowledgeable about gaming before pitching any sales.

Consider approaching Disney and the "young kids" online environments: With some 700k "Penguin Club" members Disney's server needs are currently minimal, but Disney appears poised to control much of the online landscape of the future. The New York Times reports that Second Life adoption is slowing while Club penguin is increasing: http://www.nytimes.com/2007/12/31/business/31virtual.html

Server Security issues and your product advantages might also be an important part of your pitch. In a recent major hacking event World of Warcraft logins were valued *more highly* than fully verified credit card information. I don't know but assume this reflects the high value/low risk associated with using illegal game credentials. Security is likely to become increasingly important as more of the major online game companies expand and fight for market share.

--------------------------------------------

What about Counter-Strike?

A major server based game in the USA is first person shooter Counter-Strike which evolved from "Half life" and appears to represent in the neighborhood of half the market for NON-MMORPG gaming servers. The company most important to Counter-Strike is VALVE of Kirkland, WA.

Valve is a major player with first person shooter Counter Strike, but does not have many servers: http://steampowered.com/v/index.php?area=content_stats. Also see "Game Stats". For Counter strike and other games that do not have massive server infrastructures the Game Server Providers host game servers which tend to cluster in major server "hot spots" including Atlanta, Chicago, Dallas, Denver, Los Angeles, New York, San Jose, Seattle and Washington. Some of the "big players" in the Game Server Providers:

Nuclear Fallout

Gameservers.com [I think they use RackSpace as the server farm]

Gameservers.net

Counter-strike.com

GuildPortal.com

RackSpace.com

There are also several very large gaming communities that host their own game servers without using a Game Server Provider

More data at this excellent source for game information: game-monitor.com

Source for above: Correspondence with SteamPowered.com Gaming Forum user "TheMG"

In terms of actual server hosts, Rackspace appears to be the largest game server hosting location for non-MMORPG

Valve Software

Telephone: 425-889-9642

FAX: 425-827-4843

Postal address:

PO BOX 1688

Bellevue, WA 98009

ValveSoftware.com

2005 Revenue per wikipedia: $70 million I could not find more recent revenue numbers for Valve, so the following is very speculative!....

Market Cap estimate: Valve is a private company, but with this revenue we'd expect a 2005 market cap in the neighborhood of 6.72x70MM=470MM. The 6.72 multiple is the same as Shanda's SNDA.

In this NON-MMORPG space rather than the actual hosting providers mentioned above like Rackspace, your target market is most likely the game facilitators, most important among them would be folks at Valve and possibly Counter Strike. These are the folks who are selling, ordering, and configuring thousands of servers for gaming uses. Also important is that these game facilitation companies are the most knowledgeable about server needs and expanding game opportunities.

Top Games Alphabetically - not inclusive, US Market:

Armed Assault

Americas Army

BattleField 1942

BattleField 2

BattleField 2142

Call of Duty

Call of Duty 2

Call of Duty: United Offense

Communities

Counter-Strike 1.5

Counter-Strike Source

Counter-Strike

Condition Zero

Day Of Defeat

Day Of Defeat: Source

Enemy Territory

FEAR

Game Hosts

Halo

Half Life 2

Multi Theft Auto

Natural Selection

Other

Quake 3

Quake 4

Quake Wars

Red Orchestra

Team Fortress Classic

Unreal Tournament 2004

World of Warcraft

Call of Duty series, Tabula Rasa, K III from Giant (China Market).

Also watch: Battle.net (game community), Xire.com (game community), and Punkbuster, a software to prevent cheating. Anti cheating and communications infrastructures like Punkbuster will certainly grow though I'm not clear how much or how many servers these companies use.

Xfire - NOT a good source for definitive gaming stats but offers some basic insight into the market. XFire is more popular in certain gaming communities which focus on certain games. For Steam games people tend to just use the Steam friends interface more and not have a need for XFire so the numbers for those games are quite under reported by XFire.

Source for above: Correspondence with Valve's Jmccaskey via Steam forum.

------------------------------------------------------------------

SOURCES

h ttp://www.ncsoft.net/global/ir/download/IR_Report_Eng(FY2007)-November.pdf NCsoft Corporate Report

http://www.irstreet.com/top/am/amfiles/e20060416_22.pdf Gaming Market capitalization

http://www.blizzard.co.uk/press/060406.shtml World of Warcraft Server Farm in Europe - Blizzard Press Release.

http://www.massively.com/2007/11/21/gamasutras-china-angle-reports-on-th e9-giant-interactive-nc/ China MMO Companies

http://seekingalpha.com/article/57071-china-online-search-vs-mmo-game-m arket?source=yahoo Seeking Alpha on MMO Market

http://www.businessweek.com/magazine/content/04_46/b3908040.htm Shanda profile Dec 2004

http://www.thestreet.com/_yahoo/newsanalysis/monday-business-update/10396402 .html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA Video Game Publishers

http://www.blizzard.com/press/activision-faq.shtml Activision Merger info from Blizzard

http://www.activisionblizzard.com/pressReleases/pr120207.php Blizzard Activision Merger details

http://www.massivemultiplayer.com/ = great list of MMPORG games.

http://en.wikipedia.org/wiki/NCsoft NCsoft profile - major Korean based game maker, including the up and coming Tabula Rasa...

http://blog.wired.com/games/2007/12/world-of-warcra.html World of Warcraft - game profile.

http://en.wikipedia.org/wiki/Croquet_project

Croquet application, an open source community supported architecture, may drive many future games. It currently drives Tabula Rasa which is a "game to watch".

http://www.counter-strike.com/dedicated-servers.php Counter-Strike server information but use caution as the 'server' can mean a virtual server and may not be utilized by players.

http://www.mmogchart.com/ MMOG data

http://en.wikipedia.org/wiki/Lineage_II

http://lotrovault.ign.com/View.php?view=CommunityArticles.Detail&id=11 MMOG server farms

http://www.theplanet.com/about-us/default.asp Claims to be the largest privately held dedicated server operation.

http://www.theinquirer.net/en/inquirer/news/2007/08/13/ps3-powers-serv er-farms

http://www.theregister.co.uk/2007/04/10/wow_hijackings/ World of Warcraft Security Problems

http://reports.finance.yahoo.com/w0?r=31658950:1 Reuters NCSOFT report

http://finance.yahoo.com/q/bc?s=036570.KS&t=2y&l=on&z=m&q=l& c= Yahoo on NCSOFT value

http://eng.krx.co.kr/mki/stc/stc_d_001.jsp?isu_cd=036570

http://en.wikipedia.org/wiki/Massively_multiplayer_online_game

http://www.informationweek.com/news/showArticle.jhtml?articleID=197800179&pg no=2&queryText=

|

Joseph Hunkins Tue Jan 1 12:15pm |

After reading other analyses here I agree you should also look at at least two more Korean Companies: NEXON, which produces MMORPG Maplestory and in July signed with Valve to market Counter-Strike in Asia. The potential of Counter-Strike for the Asian Market could be substantial, especially if NEXON runs the servers themselves: http://en.wikipedia.org/wiki/Nexon http://www.intel.com/business/c asestudies/nexon.pdf GRAVITY, which produces MMORPG Ragnarok, free but heavily played: Stock Symbol GRVY, Capitalization $86MM US Clearly a challenge for you in this market is defining how game playing numbers translate into server infrastructure. I'd hoped to find more server use numbers, and only Michael above seems to have done a good job with that. A nice chart would show each company mentioned above with an estimate of the servers they have running both MMORPG and non-MMORPG games. Only World of Warcraft seems to have maintained a very stable subscription growth pattern over the past years, probably making them your top potential client. |

|

Joseph Hunkins Mon Jan 7 3:52pm |

Yesterday's MMORPG session here at CES Las Vegas was really interesting. Game makers appear to be looking hard at the following, though I can't see any of this having much infrastructure effect: 1) Building in more social networking aspects to the games, including the ability to jump across from one game to another. 2) The secondary markets that involve paying real money for game items. 3) Simple and "free" MMORPGs. There seems to be a desire to capitalize on the success of MapleStory using micropayments and move to micropayments and maybe even advertising within subscribed games. Runescape was quoted here to have 17MM subscribers (I'm skeptical of that number though). I'll be with several SONY Online folks Wednesday here at CES - let me know if you have questions for them. |

|

irakli dzaganishvili Mon Aug 16 3:39pm |

thank you Joseph for a really good information. Blizzard has developed its online game market and optimizations it all time and i think world of warcraft followers will grew up to 12.5 million subscibers until the end of 2011 year. Nowadays world of warcraft is the first ranked and the development of it continues. That moment the new expansion pack has no little mistakes and it's the most important for players. thanks Best MMORPG 2010 |

Where To Sell Hardware For The Online Gaming Market? by David Cassel

Where To Sell Hardware For The Online Gaming Market? by David Cassel

Monday, December 31st, 2007 @ 11:51PM

In June GigaOm assembled their ist of the most popular massively multiplayer online worlds. Here's an executive summary. (I think most of these vendors provide their own hosting.)

The top two game companies tower over the others in terms of subscribers. They're even purchasing servers in several different countries.

Blizzard: 8.5 million subscribers

4 million "the west"

4 million in China

America, New Zealand, Canada, Australia, Mexico, South Korea, Europe, China, Singapore, Hong Kong, Macau

4 million users

New Horizon Interactive

Ganz (New York)

Gaia Interactive (San Jose)

NCsoft (North Korea)

indy Kings Three Rings

NCsoft (North Korea)

Linden Labs (San Francisco)

Wikipedia lists nearly 100 massively multi-player online games with a separate list for MMOG role-playing games, but most of these have comparatively smaller user communities.

Devin Moore

Thu Dec 20 1:38pm

Dell Poweredge 1955 : http://www.dell.com/content/products/compare.aspx/blade?c=us&l=en&s=hea& amp;cs=RC968571

http://www.dell.com/content/products/results.aspx/blade?~ck=ana v&c=us&l=en&s=hea&cs=RC968571&a=56964~0~893163&navla=569 64~0~893163

Fujitsu PRIMERGY:

http://www.fujitsu.com/ph/news/pr/20070514.html

HP, IBM, etc blades, with tests: http://www.itpro.co.uk/labs/1/enterprise-blade-servers/products.html

Devin Moore

Thu Dec 20 1:42pm